California State Tax Calculation Updates

The calculation of California state tax has been updated.

Exemptions, credits and standard deductions are based on number.

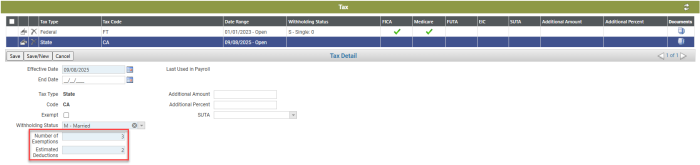

The Number of Exemptions in the Workforce Tax Detail section is used for the credit and standard deduction tax type steps in Maintenance. In the image below, the employee will use 3 for the credit step and the standard deduction step:

Human Resources > Workforce Administration > Search > Employee Number > Payroll Data > Tax

The Estimated Deductions field is new. This number is used only for the exemption type step in Maintenance. The image shows the employee will use 2 for the exemption step.

In the setup of a California employee's state tax type, the Estimated Deductions defaults as the Number of Exemptions (Number of Exemptions defaults into Estimated Deductions after deployment):

Maintenance > Human Resources > Deductions and Benefits > Tax > Type=State, Code=CA > Tax Steps